Dublin a big winner of Brexit relocations

Brexit is causing banks and investors to move some operations and jobs abroad to EU cities including Dublin, Paris, Frankfurt and Luxembourg.

11 March 2019

11 March 2019Financial services firms relocating operations to Europe

A new report from City think-tank New Financial found that 269 financial services firms already had, or were in the throes, of relocating part of their operations to Europe.The study found that 249 companies had moved primary hubs to the EU, while 213, including the likes of Barclays and Bank of America Merrill Lynch, had set up new entities in the bloc, transferring staff as well as billions of pounds in assets.As a result, New Financial estimates that as many as 5,000 jobs are likely to be moved or created in the EU in the immediate future.Estimates that 5,000 jobs likely to be moved or created in the EU

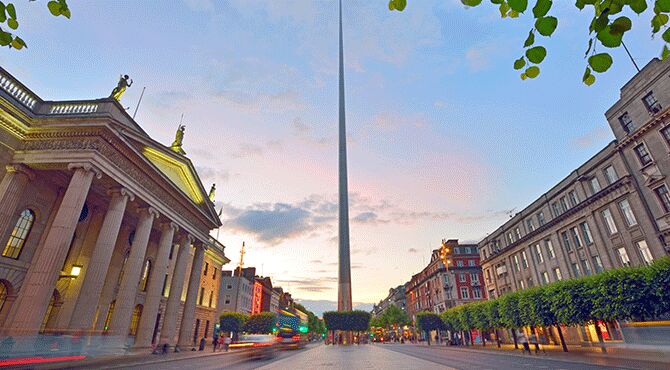

The report found that 100 firms had opted to establish operations in Dublin with 60 choosing Luxembourg. These cities were substantially ahead of those favouring Paris (41 firms), Frankfurt (40 firms) and Amsterdam (32 firms).However, both Frankfurt and Paris have proved more successful than their rivals in attracting banks, rather than other financial services firms: 87 per cent of those heading for the German city are banks and 41 per cent of those going to the French capital.Meanwhile, Dublin and Luxembourg are attracting more asset management firms.- £200 million boost for cutting-edge science

- 'Reduce visa salary threshold' say top universities

- Major boost to offshore wind farm Government-industry deal

- Berlin-London forge link to boost tech growth

Banks split operatons between Dublin, Paris, Frankfurt, Luxembourg and others

"While more than a third of moves have been to Dublin, banking giants have hedged their bets moving different parts of their operations to different cities," reported City AM."Goldman Sachs has moved its investment banking and markets divisions to Frankfurt and Paris and shifted its asset management arm to Dublin. Similarly, Credit Suisse has transferred investment banking to Frankfurt and moved its markets wing to Madrid."New Financial concluded, “While the headline numbers are stark, there is no question that London will remain the dominant financial centre in Europe for the foreseeable future.Despite moves firms keep majority of operations in London

“Firms are keen to keep as much of their business in London as possible and even the biggest relocations represent a maximum of 10 per cent of the headcount at individual firms."We expect the headline numbers to increase significantly in the next few years as local regulators across the EU require firms to increase the substance of their local operations. Other European cities will chip away at London's lead over time."The combined cost of conducting the transfers for firms is expected to be around $4 billion. Banks and investment banks alone are thought to have transferred nearly £800 billion in assets from the UK to the EU, which amounts to 10 per cent of total banking assets in Britain.But Gerard Lyons, economist at the challenger wealth manager Netwealth, said London’s position was not under threat. “All the recent evidence suggests it’s quite clear that London will remain the major financial centre in Europe after Brexit," he said.“Businesses will have to make contingency plans and there will be some changes, but there’s no doubt London will maintain that position.” Subscribe to Relocate Extra, our monthly newsletter, to get all the latest international assignments and global mobility news.Relocate’s new Global Mobility Toolkit provides free information, practical advice and support for HR, global mobility managers and global teams operating overseas.

Subscribe to Relocate Extra, our monthly newsletter, to get all the latest international assignments and global mobility news.Relocate’s new Global Mobility Toolkit provides free information, practical advice and support for HR, global mobility managers and global teams operating overseas. Access hundreds of global services and suppliers in our Online Directory

Access hundreds of global services and suppliers in our Online Directory©2025 Re:locate magazine, published by Profile Locations, Spray Hill, Hastings Road, Lamberhurst, Kent TN3 8JB. All rights reserved. This publication (or any part thereof) may not be reproduced in any form without the prior written permission of Profile Locations. Profile Locations accepts no liability for the accuracy of the contents or any opinions expressed herein.